China Factory Direct Shock Absorber Pricing: What Global Buyers Should Know

The Real Price Behind Every Shock Absorber

When international buyers search for the best deal, “factory direct” pricing often sounds like the holy grail.

But price alone rarely tells the full story.

Behind every unit shipped from China lies a web of variables — steel cost, oil viscosity grade, CNC machining precision, and test-bench validation — that ultimately determine performance, not just margin.

In a market flooded with suppliers, understanding the pricing logic helps buyers distinguish sustainable value from short-term bargains.

How Factory Direct Pricing Is Calculated

At its simplest, factory direct pricing removes trading intermediaries. Yet the math behind it is anything but simple.

-

Material Inputs: Chrome-plated rods, alloy tubing, and synthetic hydraulic oils represent 35–45 % of the total cost.

-

Process Technology: CNC finishing, robotic welding, and nitrogen charging affect both precision and consistency.

-

Volume Efficiency: Orders above 5 000 units enable automated production, lowering per-piece machining cost by up to 15 %.

-

Testing Requirements: Each endurance or leak-proof test adds roughly 0.2–0.5 USD per unit but protects brand reputation.

-

Packaging & Compliance: Export-grade cartons, RoHS documentation, and ISO tracking contribute another 3–5 % of cost.

A China factory direct shock absorber pricing sheet without these details is incomplete — transparency defines credibility.

Factory vs. Distributor Pricing

| Factor | Factory Direct | Distributor Channel |

|---|---|---|

| Cost Transparency | Full BOM and test data | Limited or hidden markup |

| Lead Time | 25–45 days | 60 + days (inventory delay) |

| Customization | CAD-based, model-specific | Mostly standard SKUs |

| MOQ | 100–300 sets | 500 + sets typical |

| After-Sales Support | Direct engineering response | Layered communication |

Direct sourcing doesn’t only lower cost — it improves technical alignment and traceability, which matters most to OEM buyers.

Quality Tiers and Price Ranges

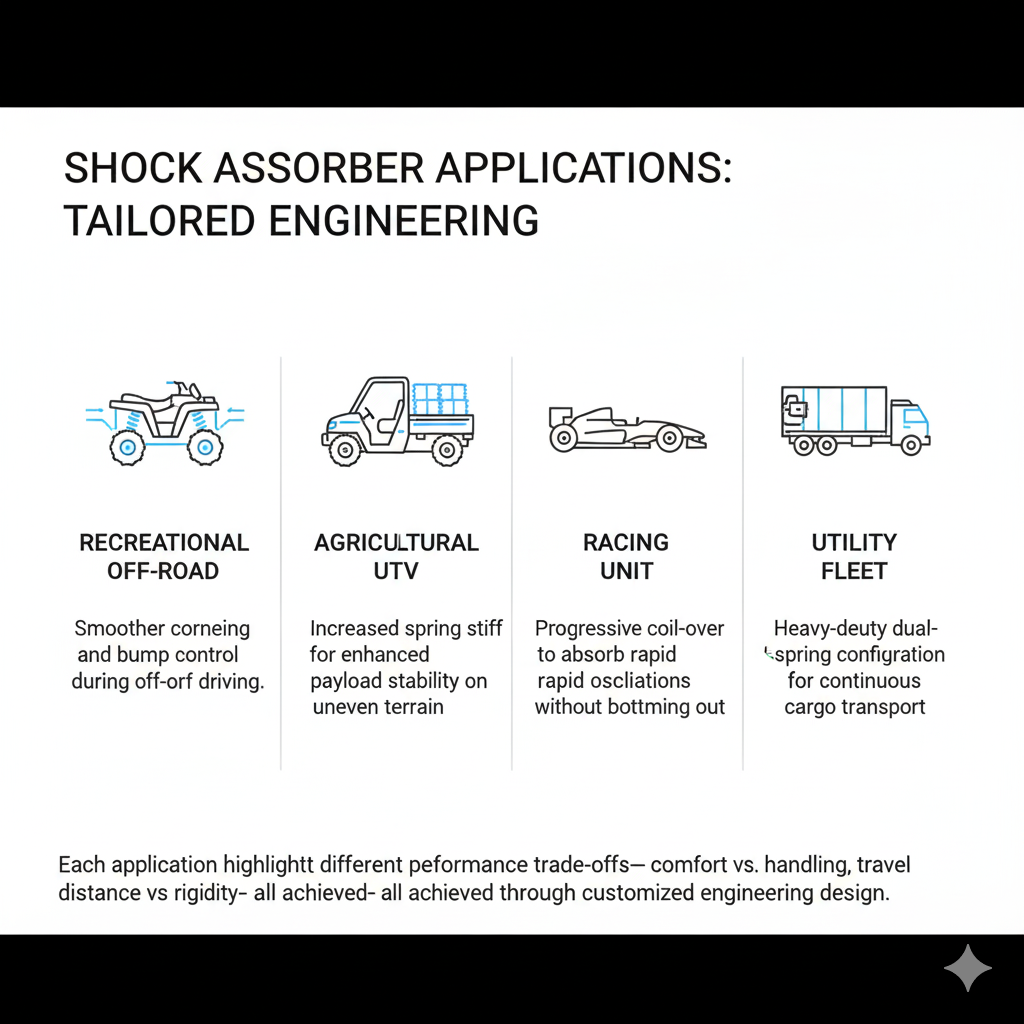

Understanding categories helps compare apples to apples.

-

Economy Tier (USD 5–8): Basic oil dampers for entry motorcycles or scooters.

-

Mid-Range (USD 9–15): Gas-assisted twin-tube units for daily commuting and light off-road.

-

Premium (USD 16–30): Adjustable nitrogen shocks, reinforced shafts, anodized housing — ideal for UTVs and sport bikes.

Realistically, factory direct pricing should vary by ±10 % based on alloy sourcing and finish type. A deal far below that often means compromised heat treatment or unverified rebound control.

Hidden Costs Buyers Often Overlook

Even experienced importers occasionally misjudge the landed cost. A few silent variables can shift profit margins quickly:

-

Exchange Rate Volatility — Steel and oil prices fluctuate with USD/CNY movements.

-

Freight Classification — Shock absorbers fall under mixed hazardous goods when gas-charged.

-

Quality Claim Risk — Returns or replacements cost more than proper pre-shipment inspection.

-

Testing Documentation — Missing certificates may delay customs clearance in EU or US ports.

Being cost-efficient starts with seeing the full financial ecosystem, not just the ex-works quote.

Advantages of Working with Certified Chinese Manufacturers

-

Scalable Capacity: Robotic lines sustain 50 000 + monthly output without tolerance drift.

-

OEM Collaboration: Engineering teams can adjust spring rate, damping, and eye-mount size per model.

-

Traceable Quality Control: Each batch logged with serial code and inspection record.

-

Flexible MOQ: Pilot orders from 100 sets help new distributors test markets.

-

Global Compliance: Adherence to ISO 9001 and IATF 16949 ensures international reliability.

These strengths make China’s suspension industry one of the most competitive in the world — not just cheaper, but increasingly smarter.

Practical Tips for Evaluating Supplier Quotes

| Evaluation Point | Buyer’s Check-List |

|---|---|

| Damping Curve Report | Request graph at 0.3–1.0 m/s compression speed |

| Warranty Terms | Minimum 1-year coverage on oil seal & damping failure |

| Material Specs | Confirm alloy type (40Cr, 50Mn2, or 6061-T6 aluminum) |

| Coating Method | Powder ≥ 80 μm / Salt spray ≥ 240 h |

| Certification | Verify ISO / RoHS / REACH documentation |

A technically detailed quote is the first sign you’re dealing with a genuine manufacturer, not a reseller.

Frequently Asked Buyer Questions

Q1: Can unit prices drop for mixed models in one order?

Yes. Most factories apply cumulative quantity discounts when total output exceeds 3 000 sets, even across models.

Q2: What is the lead time for OEM samples?

Around 20 days after drawing confirmation and material allocation.

Q3: Are gas-charged models more expensive to ship?

Slightly. They require DG labeling, adding 5–7 % to freight.

Q4: How to secure stable pricing for long-term supply?

Sign a quarterly raw-material adjustment clause indexed to China Baosteel rates.

Balancing Cost, Quality, and Trust

True value lies between transparency and performance.

China factory direct shock absorber pricing reveals its real worth only when backed by measurable quality control, responsive engineering, and honest documentation.

For global OEMs and distributors, choosing the right manufacturing partner means fewer surprises, smoother logistics, and products that speak for themselves on every road.

To explore verified suspension solutions and technical data from certified suppliers, visit our homepage or reach our sourcing team here.